First of all it’s important to understand that, for this piece, I am going to make a gross generalisation. I am going to assume that most of my readers are female in their 20s or 30s and like to consume the odd glass of wine, tall skinny latte and meal out. Oh and also that shopping rates highly on their list of hobbies too. Basically I am going to assume that most of my reader’s are like me!

Please accept my apologies if you don’t happen to fall into this particular demographic. But also, please bear with me. You see I want to talk about the budget, and well, the budget means different things to different people. The UK’s pensioners appear to have drawn the short straw this year and whilst I feel empathy for them, in a very Darwinian ‘survival of the fittest’ style curiosity. I want to know how the budget will affect me and my contemporaries.

Work

Whether you work to live, or live to work, chances are you’re still on countdown to each payday like the rest of us. Yesterday the Government pledged to increase the Personal Allowance by £1000 from April 2013. Apparently 24 million people who earn below £100,000 (most of us then) will benefit from what is being touted as ‘the largest ever increase in the Personal Allowance’. Put simply, less tax means more take home, which means more spending money. Oops, I mean money to save. Hurrah!

And, if you’re struggling to find a new job, the Government are looking to invest in businesses, which should hopefully create new jobs and help to keep businesses afloat. Admittedly working within the offshore centre for trading Chinese currency, or taking up a job on the new oil field – might not be your career option of choice. But the suits are also looking to link Public Sector pay to local situations, cut Corporation Tax, provide Tax Credits for businesses and pass low-interest rates onto small businesses through the National Loan Scheme. To quote a well-known supermarket: “every little helps”!

One thing’s for sure. If future budgets go the same way as this one, it looks as though the only way we’re going to be retiring early (or possibly even at today’s retirement age) is by saving our hard-earned cash now.

Shopping

If the Government manages to realise its aim of ensuring the ‘fastest broadband’ for 90% of the UK population, those Net-a-porter/ASOS splurges are going to be a helluva lot easier. What’s not to love? Mr O has also retained VAT exemptions on food, children’s clothes, books and newspapers. I’d prefer VAT-free handbags, but if I can’t get that then I’ll take ‘no tax on books’ as a close second. Then there’s the extended Sunday trading hours during the Olympics to look forward to. Wonder if there’s a gold medal for retail therapy?!

Babies

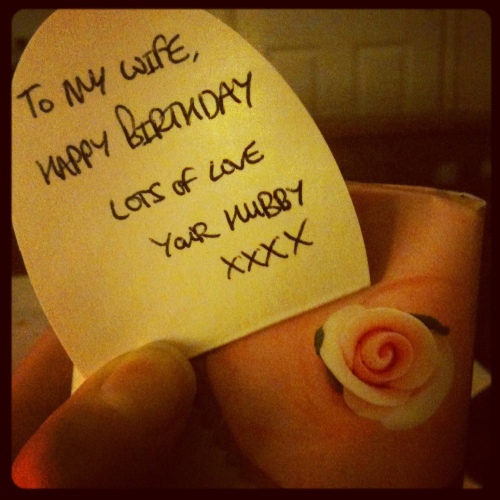

Woah! Now hold on a moment. I know I got hitched last year, but I’ve been too scared by others birth stories (and retelling of stories from One Born Every Minute, which I refuse to watch) to sprog up just yet. Child Benefit will be withdrawn from families where one parent earns more than £60,000. Seems fair enough to me to be honest. Although concerns me as to whether they’ll get rid of this altogether in the future?

Girl Racer

OK, so the Government haven’t really added any extra tax to fuel. But the 3p rise is going ahead in August as planned. Car Tax will increase in line with inflation (with the exception of hauliers). On the plus side there’s talk about more investment in transport in London (erm, hello Politicians I know this is difficult to believe, but there is a world outside of London?!). The people in power will also be looking to invest in roads (not sure that people will be able to drive on them mind), railways (hurrah) and clean energy (yay).

Girls Night Out

There’s been no extra duty added to alcohol at this stage (Yay! Crack open the rose etc…), but the government will shortly be publishing its strategy on alcohol pricing. So make the most of those affordable glasses of vino whilst you can! The rate of duty on tobacco has increased by 37p. I’m a non-smoker, so I’m quite happy about this, best not to get me started on that topic….

All in all, this budget has worked out very favourably for me and Mr Love of my Life. Although I can’t help but wonder that whilst we’re the winners at present, how long is it before the tables are turned and we become the scapegoats as pensioners have been in this year’s budget?

What are your views on this year’s budget? Will it leave you better or worse off?